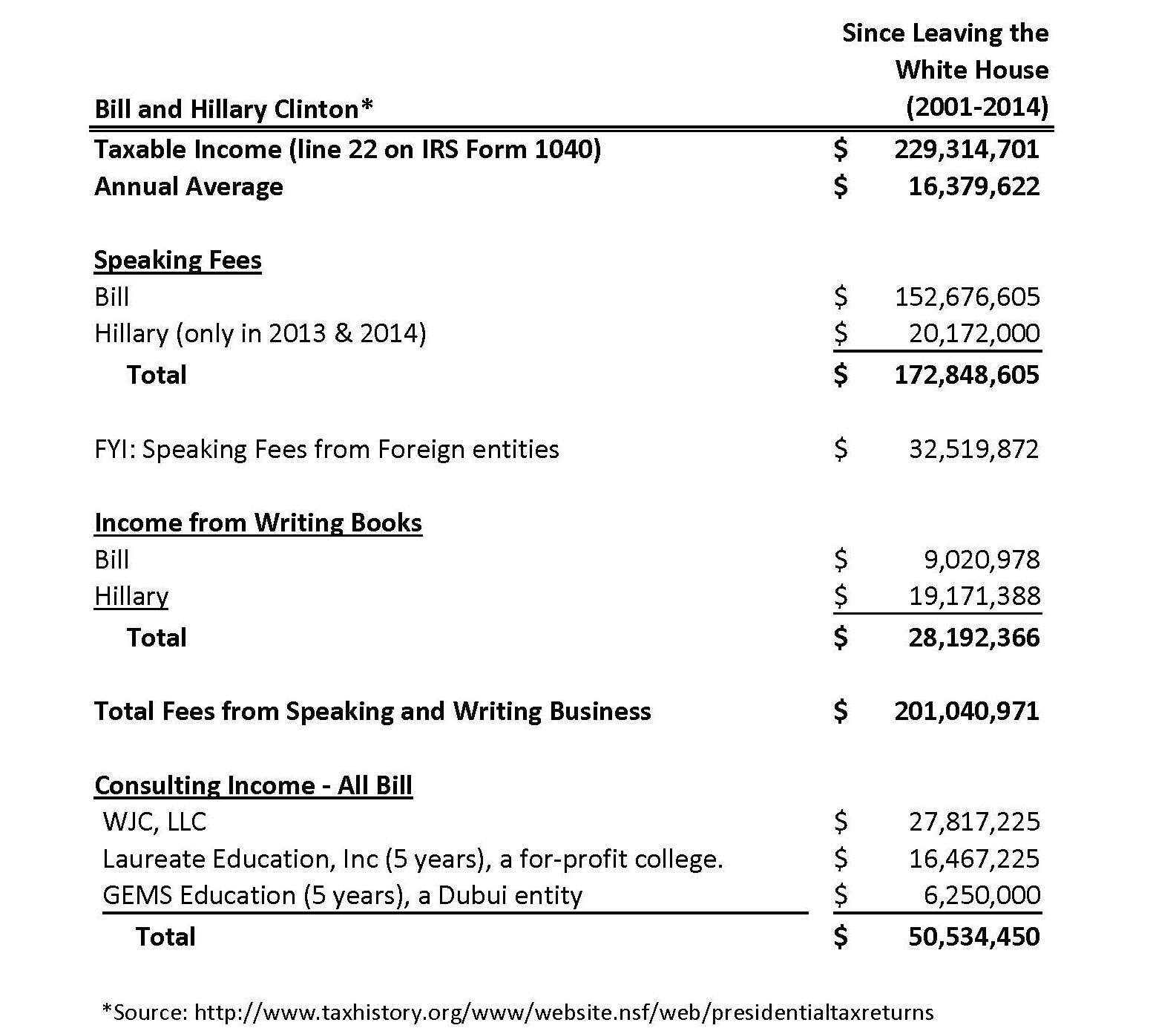

What business are the Clinton’s in? $229 million in direct taxable income since 2001. #theClintonWay

I was a commercial loan officer for most of my 16 years as a banker. I enjoyed the work and learned a ton. I spent most of my time trying to make commercial loans, and in the process I looked at hundreds and hundreds of business loan requests. This usually involved someone wanting to buy a location, a new piece of equipment, or finance larger amounts of inventory to help them grow their sales. Some requests were for new businesses, large and small, and others were for existing enterprises.

When you see a similar situation happen over and over, as I did looking at hundreds of loan requests from all types of borrowers and industries (we called that deal flow), you start to see trends emerge. That deal flow helped me develop a way to look at a business and assess its potential. So here is Paul’s quick method of evaluating a business opportunity.

When I start to explain this to someone, I instinctively put my left hand up, and start by pointing my index finger up and out, then extend my 2nd and 3rd fingers as I quickly go over the first three elements, and it starts something like this:

“Business happens when People, Ideas and Capital…”

By this time, I’ve rolled out my first three fingers on my left hand, and they are sort of hanging there, waiting on the real punchline to get into the story, a;

“…Meet Opportunity.”

When I say “meet opportunity,” my right hand instinctively wraps around those 3 extended fingers, symbolizing that opportunity is the kingpin of the elements.

Business happens when people, ideas and capital meet opportunity.

I often go on to explain that the first three elements can be shifted about in many cases. If you are short on capital but have good doses of people and ideas, you can often give it a go. The real deal stopper, every time, no matter what, is opportunity. If you have great people with skills and talent, plenty of money (capital), and a nifty idea, but the opportunity, that is, the demand from willing buyers, is lacking, then only heartache and frustration await you if you pursue this business.

When President Bill Clinton left office in January 2001, he and Hillary did what other Presidents have done. Wrote a book and gave some talks, earning a tidy sum in the process.

For example, the President who came after Clinton, George W. Bush, did similarly when he left in 2008. The Center for Public Integrity estimated (in 2012) that President George W. Bush has made $15 million giving speeches since he left office. Another critic of Pres. Bush estimates that he has made 200 speeches at rates of between $100,000 to $175,000 each, which would total $20 to $35 million. He also received a $7 million advance on his first book out of office. That’s a hefty income, something between $27 to $42 million giving speeches and writing books. We don’t know exactly what President Bush has earned, since he is out of office and does not need to provide any financial disclosures. Maybe he did some of those talks for less or more. But even his critics estimate his post-presidency income in this range.

What about the Clinton’s? Well, since Mrs. Clinton has run for and been a Senator and run for President twice, their tax returns from 1992 to 2014 are all available for you and me to review. I pulled up all of them and compiled their income sources for the 23 years from 1992 to 2014, with a summary of the years after the White House (2001-2014) below. During those 14 years, the Clinton’s made net taxable income of $229,426,701. That’s an average of $16.4 million per year, with 2014 their peak year, $28.3 million! Their speaking fees and book advances/royalties have totaled a staggering $201,040,971. That’s about 10 times more than President Bush earned from speaking/writing. Another interesting component is that $32,519,872 of the Clinton’s speaking income is from foreign payors. Additionally, since leaving office, Bill Clinton has received consulting income of $50,534,450. This includes $16 million from a for-profit college, Laureate Education, over five years, and $6 million from an education entity from Dubai, GEMS Education, during that same period.

Let’s go back to my little method for evaluating a business enterprise: Business happens when people, ideas and capital meet opportunity. Let’s break each of the elements down, briefly.

People. The Clinton’s are famous. A former US President lends credibility beyond words to any gathering. President Clinton, when he is in his zone, has an incredible way of connecting with people. His, “I feel your pain,” talks helped get him elected then re-elected, even amidst scandal. So the Clinton’s are good on this element.

Ideas. The Clinton’s are career Democrat Party politicians and are articulate the policies of their party. I’ll give them an okay on this one too.

Capital. It doesn’t take much money to write books, fly around, and give talks, so they are fine on Capital for the speaking and writing business

So, we are good on the first three elements.

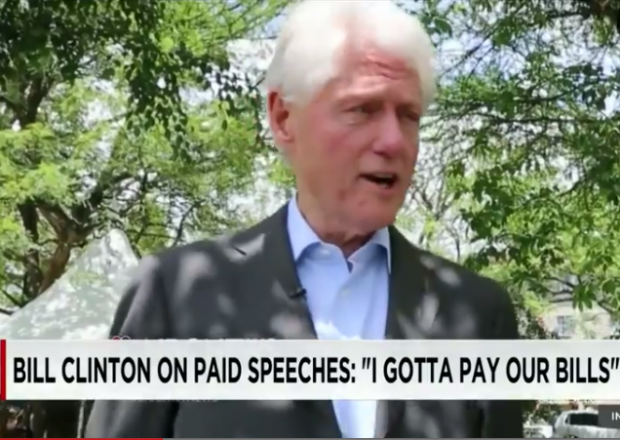

Opportunity. Here I start to scratch my head. Yes, former Presidents are very interesting. And former First Ladies/Former Senator/Former Secretary of States are as well. But the scope of their fees are just staggering. It’s one thing to have the novelty of a former President speak at your event, and it’s another thing for hundreds and hundreds and hundreds of groups to pay the former president several hundred thousand dollars a pop for a talk for over a decade.

Why are so many groups doing this? It is for the novelty? Are President Clinton and Secretary Clinton’s talks so compelling that groups will invest hundreds of thousands of dollars for a 45-minute talk? Are these groups getting that kind of motivational/inspiration to get a return on investment on those speaking fees?

Let me ask you, have you ever gone on YouTube and watched a Hillary Clinton speech because it was so compelling? Have you overhead people sharing a quote from a Bill or Hillary book or speech, other than “It takes a village?” In just two years, 2013 and 2014, the years just after she left Pres. Obama’s cabinet, Secretary Clinton was paid over $20 million to give talks. Much attention has been paid to the $675,000 she was paid for three speeches to Goldman Sachs, a Wall Street Investment Bank.

Why would a financial firm pay such a huge fee for a politician to come speak to their group? Is it to hear her wisdom on how to run an investment bank?

It seems to me that their speaking fees are much more than their celebrity power alone would yield. That is evident on the trend in Bill Clinton’s per speech fee as his wife moved in and out of her position as Senator and Secretary of State. In the year she was neither of these, 2007, his speaking income fell by half.

What is the opportunity that people/companies/foreign countries are buying when they hire the Clinton’s to speak or consult with them?

There’s a fun country expression I heard a lot when coming up, “If something walks like a duck, quacks like a duck, has feathers like a duck…it’s a duck.” This explains my view perfectly. These corporations and foreign states and NGO’s want to get on the Clinton’s good side, to influence the Clinton’s decisions. A couple hundred million dollars of direct, personal income* is Exhibit A that the Clinton’s business isn’t just giving talks and writing books, it is the sale of their future policy decisions and vast political influence.

* FYI, that couple hundred million is over-and-above gifts to the Clinton Foundation, to Hillary’s multiple campaigns for office, nor to the Democrat party or PAC’s.

We will look into some specific Clinton clients, and the role of the Clinton Foundation in an upcoming article.